The Latest in Modular Housing

Pros and Cons of Modular Homes

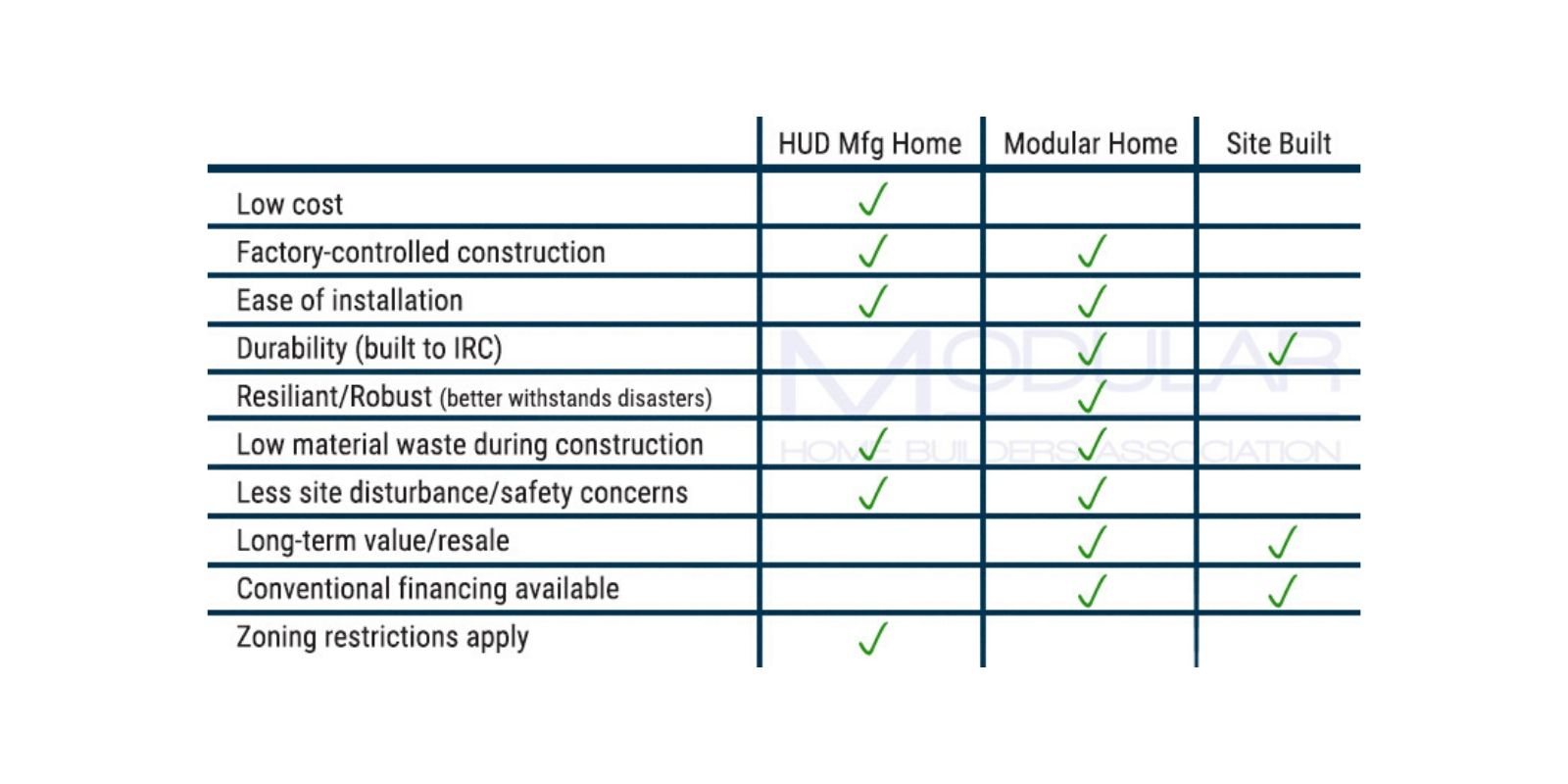

The pros of modular homes include lower costs over traditional construction methods, better quality, improved construction speed, and better resilience while the cons consist of a bit more complicated financing process, lack of customization, and the social stigma that is the consequence of the low-quality of modular homes in the past. In this article, we…

2023 Home of the Year Winners Announced!

Announced at the MHBA 2023 Annual Conference & Housing Summit, we are happy to present the 2023 MHBA Modular Homes of the Year. The MHBA Annual Conference & Modular Housing Summit is the most comprehensive meeting anywhere for modular home builders, architects, engineers, developers, and suppliers. The Modular Home Builders Association provides professionals in residential modular construction a place to network, exchange ideas, learn from experts, discuss issues, and grow professionally.

More Than Ever, The Modular Future is Now

In 2007, the United States faced a housing crisis that caused the Great Recession and had economic ramifications for years. Some people called it the subprime mortgage crisis. One cause of the crisis is that lenders gave loans to potential homeowners even if the buyers couldn’t afford them.

Is Modular Housing the Solution to the Housing Crisis?

In 2007, the United States faced a housing crisis that caused the Great Recession and had economic ramifications for years. Some people called it the subprime mortgage crisis. One cause of the crisis is that lenders gave loans to potential homeowners even if the buyers couldn’t afford them.

Creating Affordable Energy-Efficient Housing Through Modular Building

It feels like everyone — consumers and contractors alike — is looking for ways to improve their homes’ energy efficiency. Thanks to climate change, dangerously hot summers and brutally cold winters make it more challenging to keep structure interiors comfortable.

Ways a Modular Home Can Save You Money

Are modular homes cheaper than site built homes? Why are modular homes cheaper than site built homes?

What’s in a Name? Modular, Manufactured, Prefab, Offsite?

What is the difference between modular homes, manufactured homes, prefab homes, and homes built offsite?

Latest Modular Design Trends

What are the latest modular design trends? What trends are on the horizon?

Why Tiny Houses are NOT Modular Homes…Yet.

Are tiny homes the same thing as modular homes? What is the difference in a tiny home and a modular home?

Featured Manufacturers and Sponsors

Modular Home Builders for Your Perfect Home

Home is the most important place in our everyday lives. Thus, it has to be perfectly polished, every detail has to be taken care of. For that, you need to find someone who can relate to your needs and fulfill them – the ideal builder.

At Modular Home Builders Association, we help you with this mission. Not only do we provide you with our expertise in the form of our buyer’s guide, but also give you the opportunity to choose from 50 experienced builders to find the one that will align with your plans. One with whom you will build the modular home of your dreams.

Modular Home – The House of the Future

Innovation is our priority, and modular homes fit into it. They are the solution to many current problems, including the housing market crisis and sustainability. By choosing our modular home builders, you opt for a house that will be constructed with low material waste, thus in a more sustainable manner. A house that will be more affordable than a site-constructed one and require you to obtain land only. A truly modern home built from high-quality materials.

Modular Home Builders Association – Homes Built in Days That Will Last for Years

What characterizes modular homes prepared by the builders in our association are quick construction and exceptional quality. With us, your home will be over 30% faster than with regular site-construction. To add to that, due to factory-controlled construction, you can trust your modular home builders to leave you with a house that is truly flawless. This quality is proven by the long-term value of modular homes, which does not drop over time. Thus, if you wish for a home that is exceptional and quick to build, request a quote and discover how we can help you fulfill your dream.